Not Every Business Fits the Bank's Mold. You Deserve Better.

Big banks see numbers. Reliable Business Capital sees drive, resilience, and potential. Get personalized funding built around your unique business—not someone else’s checklist

Explore Lending Options That Fit Your Path Forward

Need equipment, working capital, or expansion funds after bank rejection? At Reliable Business Capital, we deliver practical funding fast—with terms that make sense for how you work.

Explore Our Financial Tools & Expert Services

Explore tailored financial solutions that propel you towards financial freedom.

Equipment Financing

Get funding to acquire equipment for your business to keep on growing.

Working Capital

Quick and simple cash available for any business purpose.

Term Loans & SBA Loans

A specialist will tailor a business loan to fit your needs. Our SBA loans have some of the lowest rates available with an SBA 7a, 504, or express loan.

Business Line of Credit

Access capital for your business when you need it and only pay interest on the funds you use.

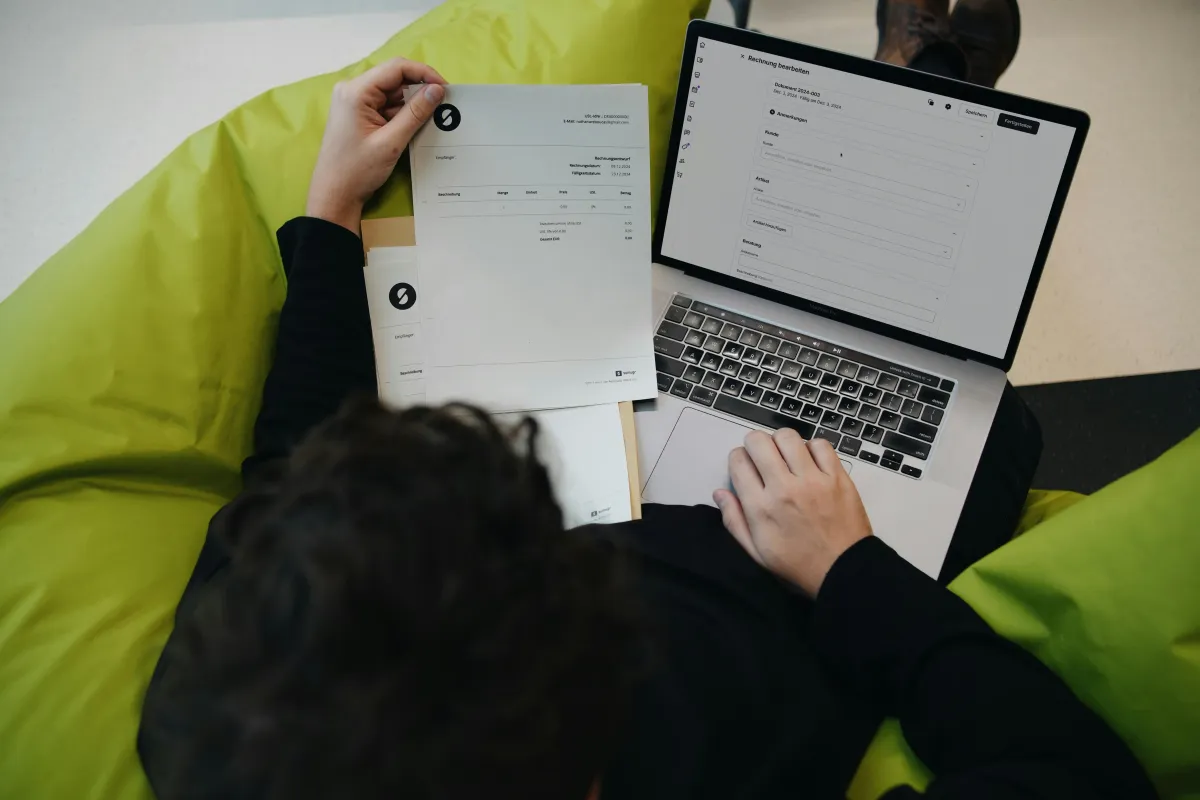

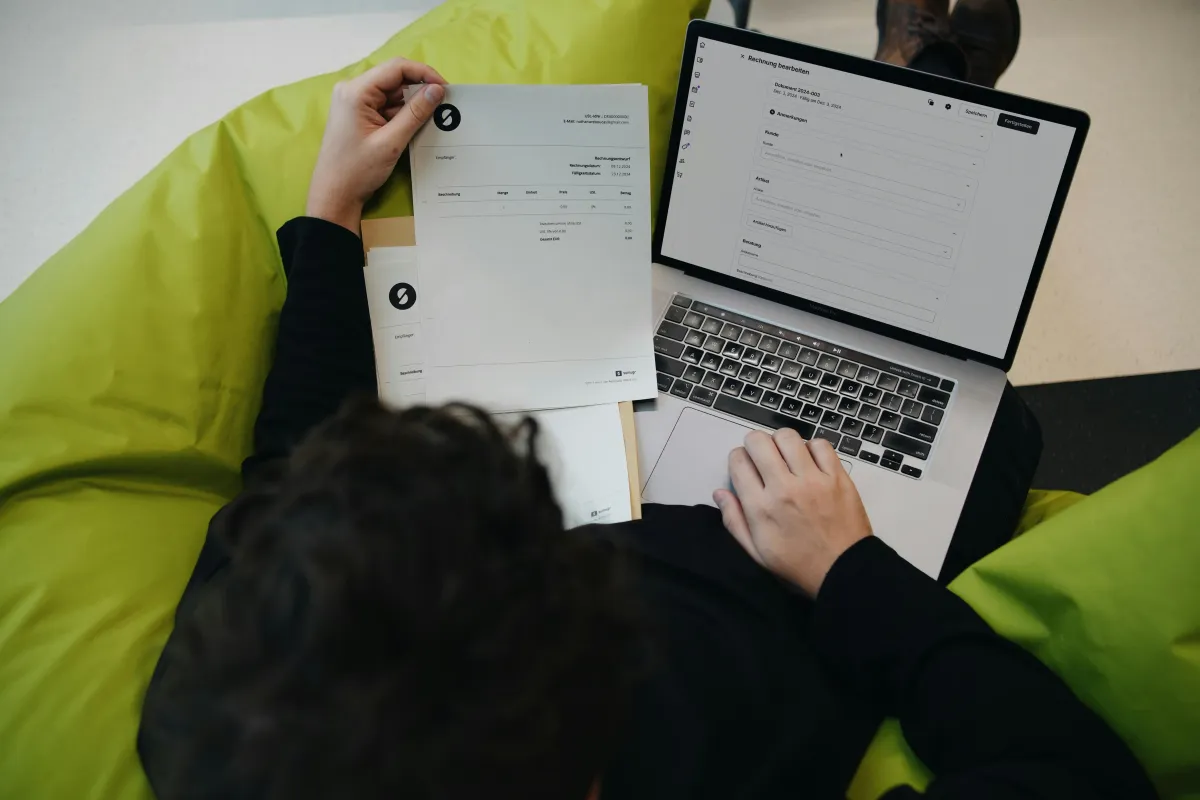

Invoice Factoring

Get paid upfront for your 30, 60, or 90 day old invoices.

Invoice Factoring

Get paid upfront for your 30, 60, or 90 day old invoices.

Commercial Real Estate Financing and Investing

Get funding for your next real estate project. Fix and Flip Funding, Single Family/Multi Family and more.

FAQs

Your Queries Answered: Navigating Financial Success with Reliable Business Capital

I have bad credit and even a previous bankruptcy. Can you get me funding?

This is one of our most frequently asked questions and the answer is YES!

If you have poor personal credit, or even have filed previously for bankruptcy, we can still provide you with working capital.

The qualifications are:

1) you have been in business for at least 3 months.

2) your business generates sales of more than $5,000 per month.

In over 85% of cases, if you meet these two requirements, we can provide you with funding!

What can I use the funding for?

It’s your money for your business, so you can use it however you see fit.

Many of our clients use funding to cover payroll, renovate, manage inventory, expand, purchase equipment, and a variety of miscellaneous business expenses.

You are the expert in maintaining and growing your company, and we are the experts in getting you the money you need to do so.

It’s a win-win situation.

What are the minimum requirements for funding?

*Minimum of three months in business.

Minimum of $5,000 in monthly revenues.

Your business is based in the United States.

*(However, we will entertain Start-Up businesses that make sense.)

How do I get started with Reliable Business Capital?

Click on any of the "Apply" buttons and fill out the

Pre-Qualified Lending Application to get started.

Are you the one funding me?

We're not the lender—We're your advantage in getting funded.

What sets us apart is our ability to navigate the lending landscape on your behalf. We know which lenders move quickly, what they look for, and how to present your business in the best light.

That’s the kind of leverage most business owners don’t have on their own.

What is your application process?

The application process is straightforward and should take about five minutes.

You can submit your application simply by clicking on any of the "Apply" buttons on our website.

Once we receive your full application and supporting documents, you'll receive an offer within 24-48 hours for most funding options.